Creditul tau personal

De Paste creditul tau personal 100% digital are 0 lei comision de analiza

Uita de teancul de documente sau formularele nesfarsite. Un proces simplu si complet digital, care dureaza doar cateva minute. Pastreaza-ti rabdarea pentru lucruri mult mai importante cum ar fi coada de la premiera filmului de care vorbeste toata lumea.

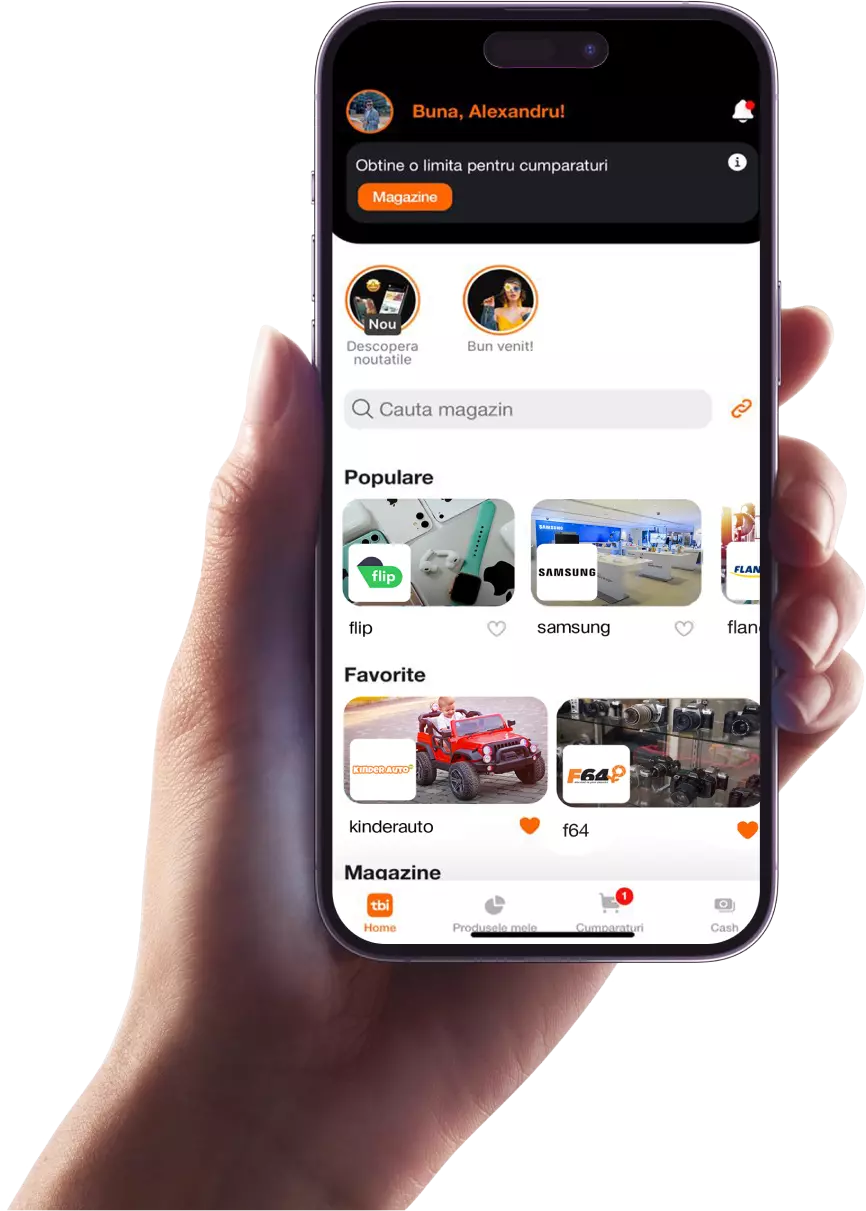

Aplicatia tbi

Descarca gratuit aplicatia tbi

- Cumperi online, de oriunde

- Platesti in 4 rate fara dobanda